Our Services

Technology Platform

About the Technology

Immutable - Policy cannot be altered, deleted, or tampered with

Transparent - All policy terms and the creation thereof are available for reviewing and auditing

Trust- Single source of truth without the need for a third-party intermediary

Automated - The technology will automatically trigger payouts per the rules embedded in the technology

Secure - Highly resistant to tampering and fraud

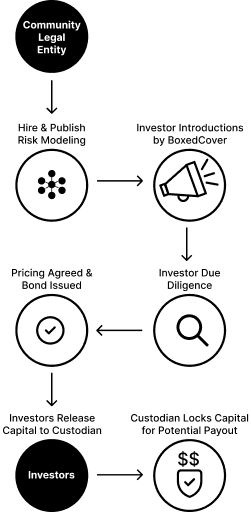

Capital Formation for Wildfire Risk

About Capital Formation

Structure: Catastrophe Bond

Issuance Proceeds: 100% of proceeds placed with custodian

Escrowed Funds: Can be invested during holding period per terms of the issuers contract

Payout Locked: Custodian holds investors funds and either releases funds to investors upon expiration or to the community should a wildfire trigger become activated

Brief and Q&A

“Parametric Insurance” defined:

The coverage being proposed by BoxedCover is called “parametric insurance” by the insurance industry. It is a type of insurance that covers the probability (or likelihood) of a loss-causing event happening (like an earthquake or wildfire) instead of indemnifying the actual loss incurred from the event.

It is an agreement to make a payment upon the occurrence of a covered event meeting or exceeding a pre-defined intensity threshold, as measured by an objective value (or parameter – hence the name 'parametric insurance').

-

The difference between indemnity and parametric insurance lies primarily in how the payout is determined and what triggers the claim.

Traditional indemnity insurance aims to restore the policyholder to their financial position before the loss occurred. Parametric insurance pays a fixed, pre-agreed amount based on an objective, measurable event (i.e., a parameter), regardless of the actual loss.

-

No. This insurance product has been around since the 1990’s. It is one the fastest growing segments and is expected to grow 9.7% to 12.8% annually. North America represents the largest geography and natural catastrophe is the largest segment.

-

There are lot of parameters that can be used as triggers to release payout. It is likely that multiple parameters will be used to best align an event with loss.

BoxedCover can give you a design kit that has information about specific devices that need installation to generate the raw data that “calculates an event”. The comprehensiveness of the design kit is based on your communities balance of savings on coverage cost - the more specific the raw data input into signaling, the lower the cost - versus device installation and maintenance cost.

Some parameters and tools to generate a parameter include:

Geospatial Image Mapping (or GIS) of a fire against a defined boundary or proximity to that boundary.

An outcome such as locations that have a burn scar

Thermal and Visual Camera Networks that identify fires and burned structures

Gas/Chemical Sensors at property locations

Multi-Modal Environmental Sensors at community borders and property locations

Acoustic Sensors

Drones and Autonomous Response Systems

AI systems that combine multiple inputs listed above

Declaration of disaster by a public authority

IoT multi-sensor devices located on or within individual homes

-

Climate Change & Catastrophes: The rising frequency and severity of natural disasters (hurricanes, floods, wildfires) create massive economic losses, only a fraction of which is covered by traditional insurance. Parametric solutions offer a rapid way to transfer this increasing risk.

Technological Advancements: The proliferation of IoT, satellite imagery, AI, and Big Data enables the creation of accurate, objective, and independently verifiable "triggers" for payouts, which is the core of a parametric product.

Speed & Liquidity: The primary benefit of parametric insurance—a quick, pre-agreed payout—is highly valued by communities, businesses and governments that need immediate cash flow for disaster recovery.

-

Yes. Although the goal is to model the coverage and loss so they align, it is possible that the payout and loss realize “basis risk” which just means the payout didn’t match the outcome well. To be clear basis risk exists in both directions - it can underpay or overpay against an outcome.

-

No. Parametric policies are very flexible. Unlike indemnity insurance which typically restricts homeowner to repairing/replacing the damaged property or covering the liability, parametric payouts can be used for anything.

-

The community’s total policy value is an aggregation of the individual policy holders desired payout amounts. During the police creation step, each participating community member declares the amount of money they believe they’ll need to repair or rebuild their home and property. It is not unreasonable for a community to decide that X% will flow to members unobstructed and Y% will make a reallocation step. However, this can complicate the main benefit which is certainty of immediate and automatic payout to get recovery started quickly. Ultimately this is a community decision.

-

A catastrophe bond, or Cat Bond”, is is a form of Insurance-Linked Security (ILS) that is primarily used by insurance or reinsurance companies to transfer catastrophic risk—typically from natural disasters like hurricanes, earthquakes, and wildfires—to capital market investors. The structure is such that the investors place the total value of coverage within a secure collateral account (usually invested in low-risk securities) administered by a major custodian. The reason 100% of the policy coverage is placed into escrow is to guarantee that funds are available should an event occur.

BoxedCover will structure the community coverage as a “Cat Bond” from the start to both attract institutional investors and reinsurers and to ensure that money is never subject to the credit risk of the insurance industry and that payout happens in real-time. -

Functionally it is a financial product and the insurance industry considers it an “Insurance-Linked-Security” or ILS. Some state insurance regulators consider ILS’s outside of their mandate and scope of work. Further, BoxedCover structures its coverage as a “Cat Bond” - which is explicitly an ILS structure - based on parametric triggers.

So from an economic POV, Parametric insurance is a financial product that transfers event risk. However, from legal POV it is likely to be considered insurance by some.

The importance of this may have tax consequences in the event of a payout. Part of the community’s own due diligence to pursue a policy is to engage its own legal opinion.

Contact us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!